If you’re considering making the switch to electric, you’ve probably wondered whether EVs need the same level of maintenance as traditional petrol or diesel cars.

Electric vehicles do require servicing, but significantly less than their combustion engine counterparts, which is just one of the many reasons they’re becoming the smart choice for UK drivers and businesses.

The Simple Truth About Electric Car Servicing

Yes, electric cars do need servicing – but here’s the thing: they require far less maintenance than traditional vehicles.

An electric motor has just one moving part compared to the thousands of components in a conventional engine. No oil changes, no spark plugs to replace, no timing belts to worry about. It’s beautifully simple.

The main areas that require attention in an electric vehicle are the tyres, brakes, suspension, and the battery system. However, even the brakes last longer thanks to regenerative braking technology, which uses the electric motor to slow the car down, reducing wear on the brake pads.

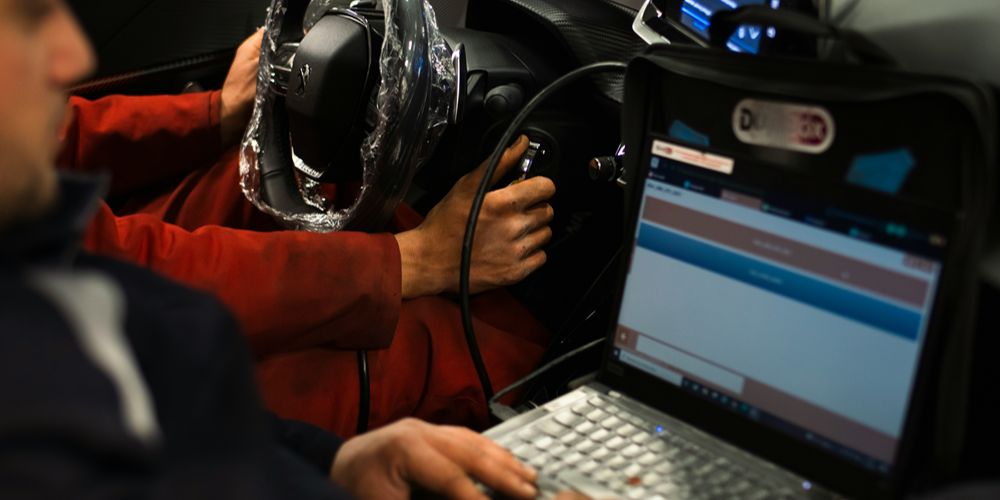

What Does Electric Car Servicing Actually Include?

When your EV does go in for its service, the technician will typically check:

- Battery and electrical systems: The heart of your electric car gets a thorough health check to ensure optimal performance and range. This includes checking the charging system and monitoring battery degradation.

- Tyres and wheel alignment: EVs are heavier than traditional cars due to their batteries, which can lead to increased tyre wear. Regular rotation and pressure checks help maximise their lifespan.

- Brakes and suspension: Whilst regenerative braking reduces wear, the mechanical brakes still need inspection. The suspension system also requires regular checks to maintain ride quality and safety.

- Cooling systems: Electric cars use sophisticated thermal management systems to keep the battery at optimal temperature. These coolant systems need periodic attention.

- Software updates: Many modern EVs receive over-the-air updates, but sometimes a visit to the service centre is needed for more comprehensive system updates.

How Often Do Electric Cars Need Servicing?

Most manufacturers recommend servicing electric vehicles every 12 months or 10,000-12,000 miles, whichever comes first. However, this varies by manufacturer and model. Some premium brands suggest longer intervals – up to 18,000 miles or two years for certain models.

The beauty of electric car servicing is its predictability. Unlike combustion engines, which can sometimes encounter unexpected issues, EVs are remarkably reliable. Many electric car owners report years of trouble-free motoring with just routine maintenance.

MOT Requirements for Electric Cars

Here’s something that catches many people off guard: electric cars still need an MOT once they’re three years old, just like any other vehicle. The test covers safety elements such as lights, tyres, brakes, and bodywork. However, there’s no emissions test (obviously!), which means one less thing to worry about come MOT time.

The Cost Benefits of Lower Maintenance

The reduced servicing requirements translate directly into cost savings. Industry studies suggest that electric vehicles can cost up to 40% less to maintain over their lifetime compared to petrol or diesel cars.

When you factor in the savings from salary sacrifice schemes – which can reduce your EV costs by up to 60% – the financial benefits become even more compelling.

Why Choose EZOO for Your Electric Vehicle Needs?

At EZOO, we understand that the switch to electric should be completely hassle-free. That’s why all EZOO services come with comprehensive coverage that takes the worry out of maintenance and servicing.

- 24/7 roadside recovery service as standard – because peace of mind shouldn’t be optional.

- Servicing is taken care of – and the cost is covered.

- MOT costs covered – when your EV needs its annual test, it’s completely taken care of.

- Comprehensive insurance included – full coverage without the paperwork headache.

This means you can focus on enjoying your electric driving experience whilst we handle all the behind-the-scenes. No surprise bills, no hunting around for qualified EV technicians, no administrative headaches.

Whether you’re exploring EVs through our salary sacrifice scheme or considering a business subscription, you’ll have complete peace of mind knowing that all maintenance aspects are covered.

Want An Easy Life? Go Electric

Electric cars do need servicing, but it’s refreshingly straightforward compared to traditional vehicles. With fewer moving parts, longer service intervals, and lower overall maintenance costs, EVs represent a smart financial choice.

When you combine this with EZOO’s all-inclusive approach, switching to electric becomes a genuinely stress-free experience.

The future of motoring is electric, and with EZOO, that future is also wonderfully simple. Why not explore our range of electric vehicles and see how much you could save whilst enjoying the benefits of hassle-free EV ownership?